How to save your money?

Post By : Jessica Abraham

Post Rank : 1836th

Category : Social-Mania

Sub Category : General News

17 Aug 2014

Saving is essentially setting aside cash or an approach to use your present pay for future utilization.

One puts something aside for a few reasons, for example, for a school training, purchasing another auto, for another TV set you wish to procure in three to four months time, for initial installment on a home, or to accommodate yourself when retirement comes.

To the extent that there are a few explanations behind sparing, there are similarly numerous strategies in which one can spare. In many occurrences, the best strategy could be controlled by whatever arrangements you have for what's to come.

1. Savings records. At the point when putting something aside for simply a brief time or for crisis purposes, think about opening as a funds account passbook, as it is in this strategy that you can without much of a stretch get access to your trusts.

Incredible for both long and fleeting funds, you can store and withdraw cash to your record and gain premium, in light of your normal every day equalization. A base equalization is obliged to be kept up however, and you are accused of a punishment if you neglect to keep up it.

2. Financial records with investment. Here one can profit from financial records accommodations, while your stores increase engages. By and large these sorts of records stipends benefits, for example, boundless withdrawal and check composing, access to ATM and bill installments that is possible on the web.

This technique regularly obliges an every day keeping up parity of in any event $2,000.

3. Currency business sector protected records. For since a long time ago termed objectives, this system is perfect, as it for the most part offers a much higher rate of investment contrasted with a normal or standard funds account.

The premium rate generally is reliant on the measure of cash in your financial balance; bigger parity implies higher premium.

4. Certificates of Deposit. This is a reserve funds technique obliging you to "advance" your cash to your fiscal office for a certain time period, typically extending from thirty days up to five years. Here, the more drawn out the time compass once more, means higher investment.

Remember that normally insurance agencies offer better arrangements on premiums contrasted with banks, so before you contribute, think about rates first!

At sure times, when your objective is numerous years away, it might be a shrewd choice to spare cash in a certain manner that you are not drawn on utilizing it other than the fundamental explanation behind sparing it. Choosing the right monetary office, for example, a bank, credit union or protection firm can achieve a great deal of profit in your funds.

Comments

Similar Posts

Good News For Teenage facebook users.!

Recently facebook announced a happy news for their...

AAP or Common Man"s Party

AAP otherwise known as the Common man"s party...

10 Amazing facts about facebook.!

10 Amazing facts about Facebook . 1. First face...

Gift 1 million Facebook likes as dowry; take away Yamani!

For people, social networking has now become a par...

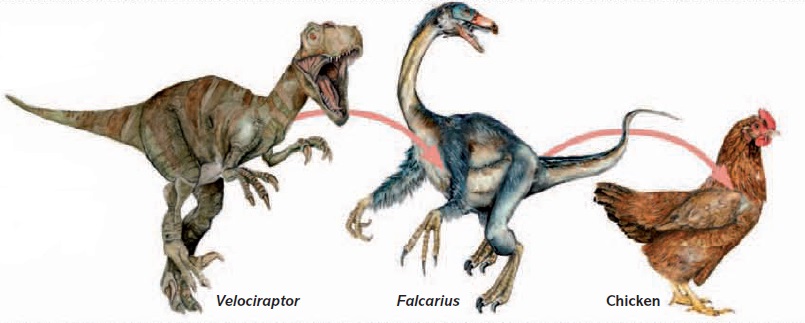

Is Chicken, a Feathered dinosaur?

Actually some scientists hint that Chicken is a ne...

10 ways to get your kids eating food!

Kids requires spoon feeding atleast till...

Playing the fools card Or accepting the facts and being ready to see and realize the truth?

So there happened to be two friends whom I used to...

Study: The girls are stronger than the boys.

The boys are creating an atmosphere of balance ...

German luxury car maker BMW launched the facelifted Z4 roadster car at Rs.68.9 lakh.

Its a two-seater sports car with a retractable har...

Maybe...Maybe- real iron men are coming soon Google announces

Maybe- real iron men are coming soon Google announ...